Sustainability, COVID-19 and staying focused on the longer term

The 2020 COVID-19 pandemic and social and economic responses are amplifying social inequalities and hampering strategic, long-term investments into sustainability by firms and governments. Researchers affiliated with Misum (Mistra Center for Sustainable Markets) discuss how the global response to the pandemic has slowed progress toward the Sustainable Development Goals adopted by the United Nations in 2015. The article emphasizes that low-income groups are most affected by the economic consequences of the coronavirus crisis, that the pandemic is reducing the ability and willingness of firms to make strategic investments, and that companies and governments need to deploy resources that ensure a sustainable recovery from the crisis.

Mistra Center for Sustainable Markets (Misum)

The current COVID-19 crisis is unprecedented both in terms of health and economic consequences. This short article assesses the impact of COVID-19 on the global Sustainable Development Goals (SDGs) adopted by the United Nations in 2015 and provides a discussion of likely long-term consequences. It observes that the COVID-19 crisis has already had severe negative effects in the short term on important SDGs. The article does not primarily refer to the disease itself and its negative consequences for health but to the impact of social distancing, lockdowns of economies and related governmental responses to the health crisis. It emphasizes two main ways through which COVID-19 poses challenges to the development of more sustainable markets. The first channel is centered around the amplification of social inequalities while the second focuses on detrimental effects on strategic, long-term investments into sustainability by firms and governments.

COVID-19 and the rise of social inequalities

Even after a few months of the crisis, evidence can be seen that gender and social inequalities have increased as a result. Low-income groups of the population are, for example, most severely affected by the economic consequences of the crisis (Surico et al., 2020). Similarly, the pandemic exhibits disproportionate negative social and economic impacts on women for multiple reasons. First, women comprise the majority of health and service care workers, requiring longer working hours and an increased risk of infection. Second, women more often work part time, making their jobs the ones more likely to be abandoned when children must stay home as schools and day-care facilities close. Third, women do three times more unpaid care work than men, further exacerbated when relatives get sick.

Finally, the pandemic leads to an increase in the inequality of opportunities. According to the latest statistics provided by the United Nations Educational, Scientific and Cultural Organization (UNESCO), at least 1.5 billion learners are now being affected by school and university closures in 191 countries. More than half of them do not have access to a household computer and 43% have no internet at home. And, of course, all these effects reinforce and amplify each other, potentially threatening recent successes in reducing these inequalities.

The pandemic has also forced many to work from home. While this has been shown to cause some immediate, short-term positive effects on the environment and might even create long-term positive effects if firms decide to adopt home-office options more widely beyond the crisis, it also creates new dimensions of inequality. For example, statistics by the US Bureau of Labor Statistics based on a survey among employees from 2019 show that the ability to work from home varies dramatically depending on occupation, industry, income as well as skill level – high-earners and high-skilled employees appear much more likely to be able to work from home than low-income, low-skilled members of the labor force.

Evidence from earlier pandemics in emerging markets

The situation regarding social inequalities might look even more challenging for emerging markets. So far in the pandemic, available evidence suggests that low-income countries have been less affected by the virus infection and its immediate health consequences than Western Europe and the United States. Whether this will remain the case also in the long run is hard to predict. On the one hand, work and living conditions often make it harder to maintain good sanitation and social distancing (including across generations) and the quality of health care systems is much more limited and underfunded in low-income countries. On the other hand, rates of transmission might be lower in areas with high temperatures. Certainly, the much younger populations of Low- and Middle-Income Countries (LMICs), whose share of those aged 65 or older amounts to only 3% as compared to 18% in high-income countries, should limit the mortality effects of coronavirus.

What is, however, expected is that the welfare costs of the broader health and economic crisis created by the pandemic and by governments’ lockdown measures will be particularly high for citizens of low-income countries. This comes from a combination of individuals and households simply having smaller margins of adjustments to income shocks, and governments having fewer resources to insure their citizens against both health and income effects. If these individuals are employed by companies dependent upon customers in their supply chains in western economies that have practiced strong lockdowns, these problems multiply.

In a developing country like Bangladesh, for example, the apparel industry accounts for 85 percent of the country’s exports. Many large retailers will source apparel from Bangladesh for their home markets. However, during the current COVID-19 pandemic workers are laid off. This will especially hurt the unregulated or informal sector. The World Bank has reported that the garment industry in Bangladesh will face unemployment exceeding one million workers.

As one of the major brands that purchases a large share of its apparel from Bangladesh, H&M has during the COVID-19 crisis agreed to pay its suppliers for the current orders produced in order to keep its close and well-functioning supplier relationships. Walmart, in contrast, cancelled orders that were completed or in progress, prioritizing short-term interests before projects or relationships that might create value or benefit in the long term. Such myopic decisions will not only hurt stakeholders further away in a supply chain, it will also hurt the possibility of building a resilient and trustworthy organization that will thrive once we are out of the current crisis. The tension between short-term and long-term decision making will be revisited later in this article.

The long-term consequences on human capital and welfare in emerging markets from the COVID-19 pandemic cannot yet be properly estimated. However, an early assessment of the most likely consequences can be gauged from previous research findings and in particular: (a) studies on the effects negative income shocks have on human capital and (b) lessons learned from the recent Ebola pandemic in Western Africa in 2014-2015. A survey in Sierra Leone showed that during the Ebola crisis, the non-agricultural informal sector was hardest hit and had a 54 percent drop in revenues, and female entrepreneurs were particularly affected (Glennerster et al., 2016). Moreover, the UN Development Programme (UNDP) estimated that after six months the Ebola outbreak had led to a substantial drop in household income of 30%, 35% and 13% in Sierra Leone, Liberia and Guinea respectively.

Similar large income drops are to be expected from the current COVID-19 pandemic as well. Previous research shows that severe aggregate negative income shocks in low-income environments lead to substantial increases in infant mortality (Baird et al., 2011; Bhalotra, 2010). Moreover, research has shown that income shocks also have negative impacts on children’s education levels. Households remove their children from schools in response to income shocks, and sometimes in order to increase the level of child labor (Beegle, Dehejia and Gatti, 2006). Importantly, the burden of these responses is not equally shared within or across households (Boyden et. al., 2015). In many settings, girls bear more of the costs: in Indonesia and Uganda, for instance, income shocks negatively affect socio-economic outcomes, including educational achievements, only among women and girls (see Maccini and Yang, 2009; Björkman Nyqvist, 2013).

Ebola and COVID-19 share several characteristics – they are both contagious and caused by a virus – but are also different in terms of ease of transmission and lethality. Importantly, societies’ responses to the viruses are quite similar, including mandatory hospitalization of suspected cases, quarantine, closure of schools and markets, banning of public gatherings, internal travel restrictions and border closures (Elston et al., 2017). Hence, important insights from the Ebola crisis in Western Africa in 2014-15 may carry over to the current situation. In a review of the existing evidence, Elston et al. (2017) suggest that human capital in the three most severely affected countries, namely Sierra Leone, Liberia and Guinea, suffered long-term consequences both from a health and an education perspective.

In terms of long-term health effects, the combination of the fear of Ebola, lack of financial resources, and the collapse of the health sector led to a dramatic reduction in health system utilization with long-term consequences. A direct impact on the ability to deliver health care came from the relatively high infection and death rates of already scarce key medical personnel. But, also, health system utilization declined sharply out of the fear of Ebola and due to a broader situation of mistrust between communities and the authorities. Such lingering mistrust has also had long-term impact on health system utilization, ultimately impacting negatively on health outcomes in general. For example, Sierra Leone had a 28% reduction in facility-based deliveries and Liberia had a 31% reduction in maternal, newborn, and child health utilization (Ribacke et al., 2016). Estimates from one district in Sierra Leone revealed that the number of deaths was 3.4 times higher during the outbreak compared to a year before, with 42 percent occurring in children less than five years old. Of all these deaths, only two percent were attributed to Ebola (Elston et al., 2015).

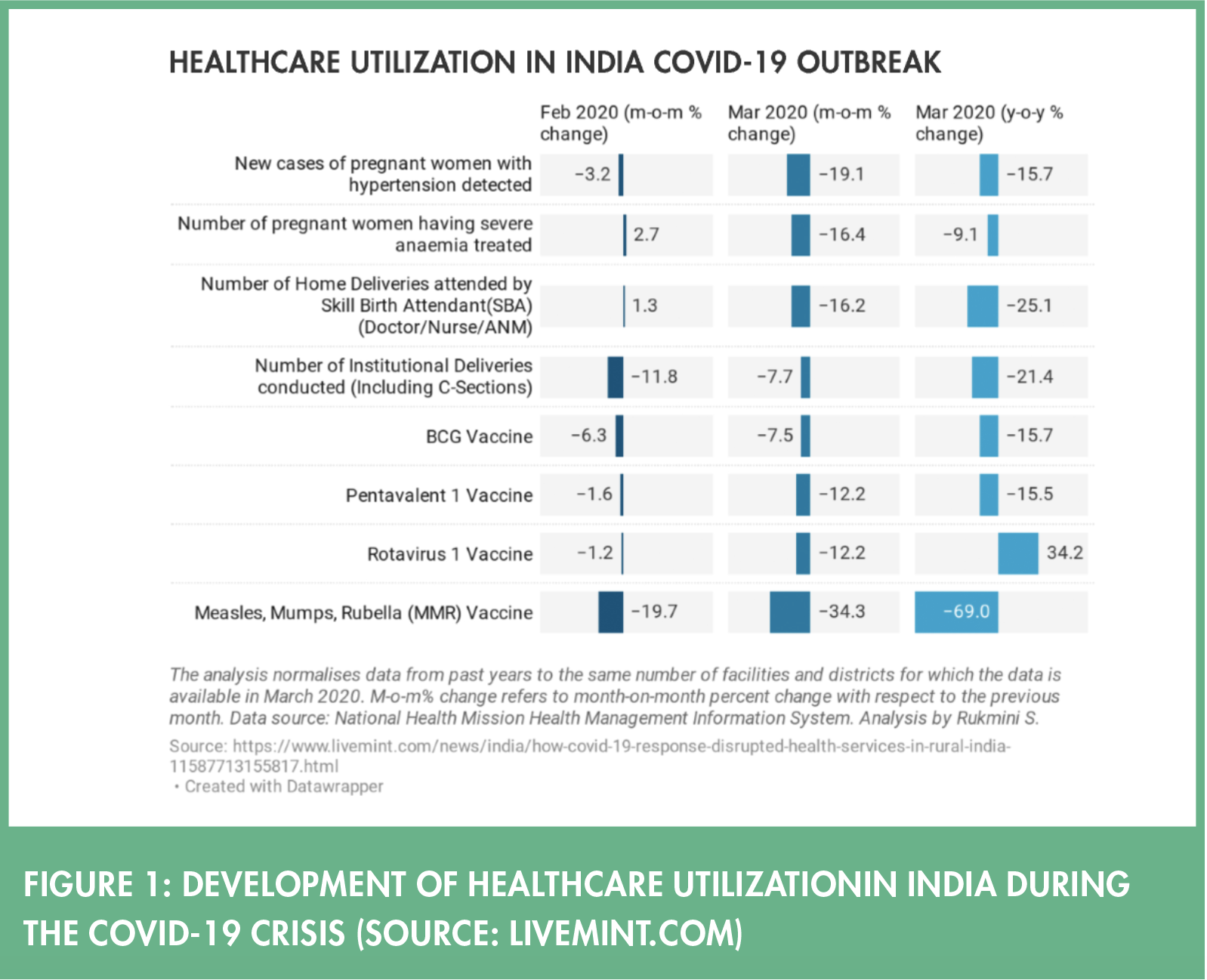

During the ongoing COVID-19 pandemic, similar sharp decreases of general healthcare utilizations are witnessed in many developing countries with reductions in immunization rates etc. The above picture shows evidence from reductions in health utilization in India after the COVID-19 outbreak. Clearly, measures to encourage citizens to maintain their public health investments such as immunizations, antenatal care and similar are important in order to not end up with an unnecessary large number of deaths after the pandemic is over.

The school closures seen across the world as a measure to reduce the spread of COVID-19 will also most likely have long-term consequences. Here we can learn from previous pandemics in terms of education outcomes. In the Ebola crisis, the United Nations Children’s Fund (UNICEF) estimated that five million children may have lost a year of education. Many children never go back to school. The effects of the current pandemic, much more widespread globally with school closures a common response, is likely to be even more severe. Support from the international community is highly needed when restarting the school systems in developing countries to minimize the risk of long-term educational impacts on the younger generation.

As mentioned earlier, COVID-19 will pose challenges to the development of more sustainable and socially equal societies in the long term. Efforts from the global community are needed to limit the long-term impacts. The pandemic will also have detrimental effects on strategic, long-term investments into sustainability by firms and governments and some of those impacts will be discussed next.

COVID-19 induced reductions in strategic, long-term investments

COVID-19 is expected to have negative impacts on the transition to more sustainable markets by reducing the ability and willingness of firms to do strategic investments. Two main mechanisms are identified here through which these negative effects materialize. The first can be labelled the cash-flow spiral (Galeotti and Surico, 2020). In this framework, the pandemic leads to a substantial reduction in household demand which results in firms losing their cash-flows, potentially sending them into default, which in response implies that workers lose their jobs, further lowering the demand by households. The current crisis also includes a lockdown of production (supply) which further reinforces this negative cash-flow spiral. Another mechanism that can negatively affect the willingness of firms – even those able to maintain sufficient cash-flow levels – to invest in long-term projects contributing to the transition to more sustainable economies is short-termism. Corporate decision makers, potentially in response to investor pressure, prioritize short-term crisis management over long-term value maximization (Marginson and McAulay, 2008). In the following paragraph, these two mechanisms are commented on in more detail.

It is known from previous research that there tends to be a positive correlation between corporate social performance and corporate financial performance (Friede et al., 2015; Khan et al., 2015). This seems to also hold true during times of global crisis: during the recession of 2008-2009, US non-financial firms with high environmental and social ratings had better financial ratings than other firms (Lins et al., 2017). While it is still early days to draw conclusions from the COVID-19 pandemic, new research shows that companies which score well on environmental and social dimensions withstand the crisis better in terms of stock resilience: US firms with high sustainability ratings showed significantly higher returns and lower return volatilities than stocks with low ratings during the first quarter of 2020 (Albuquerque et al., 2020). Similarly, one study using data on over 6 000 companies across 56 economies shows that the pandemic-induced drop in stock prices was milder among firms with more CSR activities (Ding et al., 2020). It has also been recorded that Chinese firms with greater employee satisfaction endure the COVID-19 stock market downturn better than other firms (Shan and Tang, 2020). Thus, these studies make a case that firms should not abandon strategic investments into sustainability as such investments might make them more resilient in future crises.

Impact on SMEs, start-ups and innovation leaders

Given how the COVID-19 crisis is unfolding, it is clear that its impact is playing out differently from country to country. This makes it difficult to identify a workable solution for all and for policy-makers to identify short-term quick and fast mechanisms for managing the fallout of this crisis. We are led to believe that an estimated 59 million jobs are at risk and a staggering 80% of workers are currently facing issues related to job security because of the impact and fallout from COVID-198. This brings to the fore the impact COVID-19 will have on business and economies and implies that for many, some form of recovery will take time. Therefore, governments, support bodies and the business community need to assess short-term responses and longer-term value maximization.

What is being witnessed is a massive suffering of huge numbers of firms, especially those which are smaller and have access to limited resources. What is even more concerning is that these smaller organizations are the types of firms central to economic development strategies for many Western governments (Sautet, 2013). They are also where the majority of jobs lie. But investments by firms and support especially for small entrepreneurs are drying up. Indeed, in many countries there has been very little – if any – support for start-ups, which is where the future might lie.

Given this dramatic situation for many firms, what might crisis management on an organizational level look like, and what can we learn from previous research in this vein?

An organizational crisis has been described as a low-probability high-impact situation that ultimately threatens the survival of the organization (Maitlis and Sonenshein, 2010). Often, accounting is used as a sensemaking device in these situations, guiding organizational decision making in and through the crisis. Research about accounting’s role during crises has shown that outcome controls such as budgets (Becker et al., 2016; Ezzamel and Bourn, 1990) tend to play an important role for companies to navigate such challenging times. For example, during the recession of 2008-2009, Becker (2014) showed how his case company, a bank, re-introduced the budget as a device for crisis management, although it had abandoned it a few years earlier. Makrygiannakis and Jack (2016) studied the financial crisis in a Greek context and observed that the use of budgeting was used constantly to follow the development during the crisis. In this case, the authors found that other performance measures, such as quality, became less important during the crisis. Hence leading indicators, important for future prosperity, were put aside during this time of crisis.

Importantly, we also observe a tendency that even firms without resources to invest are being cautious and mindful of the situation and its possible knock-on effects. A recent survey by the University of Edinburgh Business School9 showed that among a sample of 565 entrepreneurial businesses, half have stopped all strategic investment. Addressing the UK situation, Professor Francis Greene (Edinburgh University) noted with regard to the survey: “COVID-19 has caused significant losses for over half of our most growth-oriented companies and stalled a substantial proportion of investments. These firms are the key growth engine of the economy…. we will depend on their entrepreneurial dynamism to repair the UK economy after COVID-19…”.

Again, it might be useful to relate to experiences and lessons learned in earlier crisis situations. During the telecommunication crisis in the early 2000s, for example, the multinational telecommunication vendor Ericsson was in deep financial trouble and budgeting was a critical tool for management in the downsizing (and cost cutting) of the company (Strömsten, 2020). However, management was also cautious to not abandon critical projects that would be important in the future. Hence, more or less deliberately, the company was managed with at least two different time horizons, one for survival and the second for a time when the company was to invest again and to hopefully thrive.

Interestingly, innovative start-ups are thought to be better prepared than many other types of firms to cope with the crisis brought on by COVID-19 (Kuckertz et al., 2020, p. 2). Yet, monitoring and developing how these types of start-ups as well as other firms cope through these times will be critical as most studies on crisis management (Williams and Vorley, 2015) and resilience (Doern et al., 2019) have taken place prior to this particular pandemic.

Conclusion

The United Nations is looking to achieve its SDGs by 2030 but as a result of COVID-19 the world’s problems are becoming much bigger challenges. Thus, how individuals and organizations work to ensure that “a sustainable world exists for future generations” (Ratten and Welpe, 2011, p. 283) could also become more difficult. Yet, moving forward, there will be an even greater need for communities to come together, engage with others pro-actively and collectively contribute to solving social and economic challenges through pooling knowledge, experience and resources to provide sustainable solutions.

This article has summarized and reflected on important challenges that the COVID-19 crisis is posing for the ongoing transition towards more sustainable markets focusing on two main aspects: the increase in inequalities and the abandonment of strategic investments into sustainability. Myopic behavior becomes salient in these times of COVID-19, when fighting close fires becomes top priority while fighting fires far away – and even fires that might not even have started yet, but whose ultimate consequences will be greater – are put aside. The view here is that resource allocation and decisions impacting the current crisis situation should not, to the extent possible, compete with resources allocated for longer-term consequences.

Organizations must certainly survive but also live and thrive once the crisis is over. It is the case, as described, that the long-term focus on setting up economically, socially and environmentally sustainable businesses builds organizational resilience to crisis and, as much as we would like, COVID-19 might not be the last time a global crisis of this magnitude is experienced. Being mindful of the arguments outlined in this article, corporate as well as political leaders can make active choices to follow a strategic path that serves the Sustainable Development Goals also post COVID-19.

References

Albuquerque, R. A., Koskinen, Y. J., Yang, S. and Zhang, C. (2020). Resiliency of Environmental and Social Stocks: An Analysis of the Exogenous COVID-19 Market Crash. European Corporate Governance Institute – Finance Working Paper No. 676/2020 (online article).

Baird, S., Friedman, J. and Schady, N. (2011). Aggregate Income Shocks and Infant Mortality in the Developing World, Review of Economics and Statistics,

93 ( 3), 847-856.

Becker, S. D., Mahlendorf, M. D., Schäffer, U. and Thaten, M. (2016). Budgeting in times of economic crisis, Contemporary Accounting Research, 33(4), 1489-1517.

Becker, S. D. (2014). When organisations deinstitutionalise control practices: A multiple-case study of budget abandonment, European Accounting Review, 23(4), 593-623.

Beegle, K., Dehejia R. H. and Gatti, R. (2006). Child labor and agricultural shocks, Journal of Development Economics, 81(1), 80-96.

Bhalotra, S. (2010). Fatal fluctuations? Cyclicality in infant mortality in India, Journal of Development Economics, 93(1), 7-19.

Björkman-Nyqvist, M. (2013). Income shocks and gender gaps in education: Evidence from Uganda, Journal of Development Economics, 105, 237-253.

Boyden, J., Dercon, S., & Singh, A. (2015). Child development in a changing world: Risks and opportunities. The World Bank Research Observer, 30(2), 193-219.

Ding, W. Levine, R. Lin, C. and Xie, W. (2020). Corporate immunity to the COVID-19 pandemic, NBER Working Paper No. 27055 (online article).

Doern, R., Williams, N. and Vorley, T. (2019). Special issue on entrepreneurship and crises: business as usual? An introduction and review of the literature, Entrepreneurship and Regional Development, 31, NOS. 5–6, 400–412.

Elston, J. W., Cartwright, C., Ndumbi, P. and Wright, J. (2017). The health impact of the 2014-15 Ebola outbreak, Public Health, 143, 60-70.

Elston, J. W., Moosa, A. J., Moses, F., Walker, G., Dotta, N., Waldman, R. J. and Wright, J. (2015). Impact of the Ebola outbreak on health systems and population health in Sierra Leone, Journal of Public Health, 38(4), 673-678.

Ezzamel, M., and Bourn, M. (1990). The roles of accounting information systems in an organization experiencing financial crisis, Accounting, Organizations and Society, 15(5), 399-424.

Friede, G., Busch, T. and Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, 5(4), 210-233.

Galeotti, A. and Surico, P. (2020) A User Guide to COVID-19: gathering the facts, health policies and macroeconomic implications

Glennerster, R., Suri, T. and Bhogale, S. (2016). The implications of the Ebola outbreak on markets traders, and food security in Sierra Leone, IGC Bulletin on Ebola Impact number Seven.

Khan, M., Serafeim, G. and Yoon, A. (2015) Corporate sustainability: First evidence on materiality, The Accounting Review, 91(6), 1697-1724.

Kuckertz, A., Brandle, L. Gaudig, A., Hinderer, G., Arturo Morales, Reyes, C., Prochotta, A., Steinbrink, K.M. and Berger, E.S.C. (2020). Startups in times of crisis–A rapid response to the COVID-19 pandemic, Journal of Business Venturing Insights, 13 (online article).

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social capital, trust, and firm performance: The value of Corporate Social Responsibility during the financial crisis, Journal of Finance 72(4), 1785-1824.

Maccini, S. and Yang, D. (2009). Under the Weather: Health, Schooling, and Economic Consequences of Early-Life Rainfall, American Economic Review, 99(3), 1006-1026.

Maitlis, S. and Sonenshein, S. (2010). Sensemaking in crisis and change: Inspiration and insights from Weick (1988), Journal of management studies, 47(3), 551-580.

Makrygiannakis, G. and Jack, L. (2016). Understanding management accounting change using strong structuration frameworks, Accounting Auditing & Accountability Journal, 29(7).

Marginson, D. and McAulay, L. (2008). Exploring the debate on short‐termism: A theoretical and empirical analysis, Strategic Management Journal, 29(3), 273-292.

Ratten, V. and Welpe, I. (2011). Special issue: Community-based, social and societal entrepreneurship, Entrepreneurship and Regional Development, 23 (5-6), 283-286.

Ribacke, K., Saulnier, D., Eriksson, A. and Schreeb, J. (2016). Effects of the West Africa Ebola Virus Disease on Health-Care Utilization – A Systematic Review. Frontiers in Public Health, 4 (online article).

Sautet, F. (2013). Local and Systemic Entrepreneurship: Solving the Puzzle of Entrepreneurship and Economic Development, Entrepreneurship Theory and Practice, 37(2), 387-402.

Shan, C., and Tang, D. Y. (2020). The value of employee satisfaction in disastrous times: Evidence from COVID-19, Working Paper available at SSRN (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3560919).

Strömsten, T. (2020). Representing and Constructing a Financial Crisis. The Case of Ericsson during the telecommunication crisis. Working Paper Stockholm School of Economics (online article).

Surico, P., Kaenzig, D. and Hoke, S. (2020). Consumption in the time of COVID-19: Evidence from UK transaction data, CEPR Discussion Paper No. 14733 (online article).

Williams, N. and Vorley, T. (2015). Institutional asymmetry: How formal and informal institutions affect entrepreneurship in Bulgaria, International Small Business Journal, 33(8), 840–861.

The Authors

The article was written by the following Misum affiliated researchers.

Martina Björkman Nyqvist is Executive Director of Misum and Associate Professor at the Department of Economics at Stockholm School of Economics (SSE).

Pamela Campa is Assistant Professor of Economics at Stockholm Institute of Transition Economics (SITE).

Emilia Cederberg is Assistant Professor at the Department of Accounting at SSE.

Tatiana Egorova is a PhD student at the House of Innovation at SSE.

Michael Halling is Associate Professor at the Department of Finance and Swedish House of Finance at SSE.

Sarah Jack is the Jacob and Marcus Wallenberg Professor of Innovative and Sustainable Business Development at the House of Innovation at SSE.

Henrik Nilsson is Professor at the Department of Accounting at SSE.

Mattias Nordqvist is Professor of Business Administration at the House of Innovation at SSE. Anders Olofsgård is Associate Professor at SITE.

Maria Perrotta Berlin is Assistant Professor at SITE.

Marek Reuter is Assistant Professor at the Department of Accounting at SSE.

Abhijeet Singh is Assistant Professor at the Department of Economics at SSE.

Emma Sjöström is Research Fellow at the Department of Marketing and Strategy at SSE. Torkel Strömsten is Associate Professor at the Department of Accounting at SSE and Visiting Professor KTH Royal Institute of Technology.