Nobel Prize in Economics for research on banks and financial crises

The Royal Swedish Academy of Sciences has decided to award the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022 to research that has proven to be of great practical importance in regulating financial markets and dealing with financial crises.

“The laureates’ insights have improved our ability to avoid both serious crises and expensive bailouts,” says Tore Ellingsen, Professor of Economics at SSE, and Chair of the Committee for the Prize in Economic Sciences.

Ben Bernanke, Douglas Diamond and Philip Dybvig laid the foundation for modern banking research in the early 1980s. Today this research helps us understand not only the role of banks in the economy, but also how to make banks less vulnerable in crises and why avoiding bank collapses is vital.

Social function of banks

Douglas Diamond and Philip Dybvig looked at the important social function played by banks, as intermediaries between savers and borrowers. Their function as a middleman means that banks are well suited to assessing borrowers’ creditworthiness and ensuring that loans are used for good investments. Diamond’s and Dybvig’s analysis shows how this role makes banks vulnerable during a crisis, when savers run to the bank to withdraw their money, but also how governments can help prevent bank runs by providing deposit insurance and acting as a lender of last resort.

Ben Bernanke’s research showed how bank runs where a decisive factor in worsening and prolonging the Great Depression of the 1930s, the worst economic crisis in modern history. When the banks collapsed, valuable information about borrowers was lost and could not be recreated quickly. Society’s ability to channel savings to productive investments was thus severely diminished.

Importance of evidence-based policies

Even though the timing of this particular subject matter seems very opportune, as the world is edging dangerously close to a global recession, Tore Ellingsen is quick to point out that the Committee does not choose the laureates based on what is happening during a particular year.

“In any given year there are several possible recipients. Who is ultimately picked depends on several factors, not least how far we have come in our preparations. We need to be convinced that the research is important enough and we need to be ready to explain these contributions in an accessible way,” says Tore Ellingsen. “We have learnt a lot about what happens during a crisis since there is – unfortunately, perhaps – a lot of data from the past decades. Without the financial crisis of 2008, we might not have felt sure about these laureates.”

Although current events might not have played a role in the Committee’s choice, highlighting their research at this particular time only serves to highlight the importance of evidence-based policies:

“I think some of the laureates saw the problems coming before the crisis in 2008. But society didn’t listen. After the crisis people have listened much more closely and we have also learned how to appreciate the power of their arguments", says Tore Ellingsen. “The COVID-19 pandemic could have easily caused a new financial crisis, but policy makers had learned the lesson that societies are dependent on well-functioning financial intermediation.”

SSE and the Nobel Prize

Tore Ellingsen is not the only SSE faculty member to be part of the Committee for the Prize in Economic Sciences. Per Strömberg, Professor of Finance and Private Equity, is also a long-time member of the committee. This year, however, he recused himself from the decision-making process, due to his affiliation with the University of Chicago Booth School of Business, where Douglas Diamond serves as the Merton H. Miller Distinguished Service Professor of Finance.

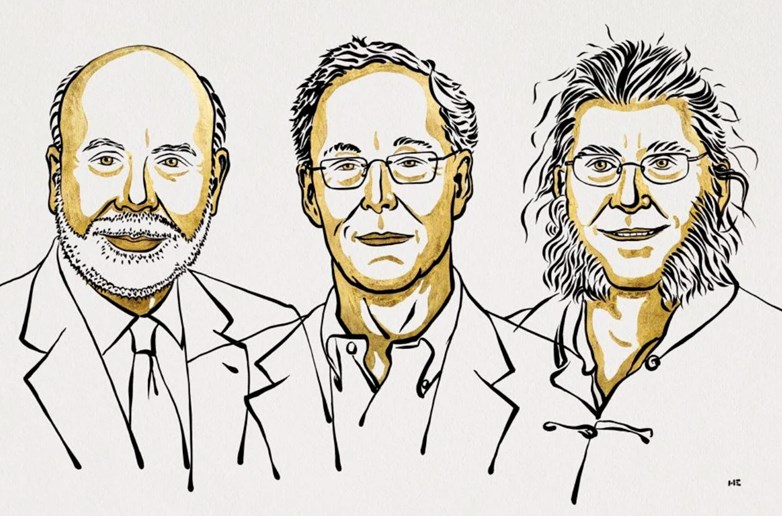

The 2022 Nobel Laureates

Ben S. Bernanke, born 1953 in Augusta, GA, USA. PhD 1979 from Massachusetts Institute of Technology, Cambridge, USA. Distinguished Senior Fellow, Economic Studies, The Brookings Institution, Washington DC, USA.

Douglas W. Diamond, born 1953. PhD 1980 from Yale University, New Haven, CT, USA. Merton H. Miller Distinguished Service Professor of Finance, University of Chicago, Booth School of Business, IL, USA.

Philip H. Dybvig, born 1955. PhD 1979 from Yale University, New Haven, CT, USA. Boatmen’s Bancshares Professor of Banking and Finance, Washington University in St. Louis, Olin Business School, MO, USA.