Perceptions about quarterly earnings

In this article, Michał Dzieliński and Florian Eugster compare earnings calls from Swedish and American companies from January 2019 to May 2020. Analyzing 3,677 transcripts, the authors find that COVID-19 clearly impacted companies’ financial communication regardless of country. However, comparing the countries, it is also shown that Swedish companies were more positive and less uncertain about the future. If these differences are caused by a better underlying performance or different rhetorical strategies in Sweden and the USA remains to be seen for future research.

Michał Dzieliński and Florian Eugster

The novel SARS-CoV-2 virus originated in China and spread with lightning speed around the globe, causing the ongoing global pandemic of COVID-19. What seemed mostly like a “foreign” issue as recently as February quickly became a clear and present danger in Europe and eventually in the Western hemisphere. Governments initially focused on keeping the virus out by closing borders but, as that proved insufficient, had to shift attention inwards by imposing near-total lockdowns in many cases. The toll on people’s health and the world’s economy has been massive, and the path to recovery is still uncertain.

How did the business community discuss these developments? Were international and domestic-oriented firms differently affected? Furthermore, did Swedish companies differ from their foreign peers, given Sweden’s exceptional, “soft touch” response to the pandemic? We look for answers to these important questions in the transcripts of quarterly earnings calls. The quarterly earnings call is the opportunity for the firm to discuss current issues within the firm and industry. Even though they are not mandatory, the majority of publicly listed companies organize them together with the release of quarterly reports. More than 90% of the calls are attended by the CEO or CFO (and usually both), further underscoring their importance. The typical call starts with a presentation of the past quarter and then moves over to the questions and answer session (Q&A), with participating financial analysts.

We obtained the earnings call transcripts of 176 Swedish companies from the OMX SPI index, as well as the 500 largest US companies, constituents of the S&P 500 index, for the period January 2019 - May 2020. The sample consists of 3,677 transcripts, each of which contains 4,200 words on average. Processing such a vast amount of text calls for the use of automated textual analysis. We designed a computer algorithm that scans each transcript for words from specific pre-defined categories and returns the frequency of those words. We were particularly interested in finding out:

- To what extent was the topic of COVID-19 discussed in the calls?

- What was the overall tone? (positive vs. negative words)

- How much uncertainty was revealed in the discussions?

Ad 1. We considered the following list of COVID-related keywords, compiled from Hassan et al. (2020) and Ramelli and Wagner (2020): "sarscov", "coronavirus", "corona virus", "ncov", "COVID", "COVID-19", "2019-ncov", "sars-cov-2."

Ad 2. We measured the tone based on the lists of positive and negative words from Loughran and McDonald (2011), which have become that standard in accounting and finance research. The lists were handpicked, following a careful analysis of annual reports, specifically to focus on words that are positive and negative in the financial context, as opposed to general linguistic sentiment. The most frequent words in the negative list are “loss”, “impairment”, and “adverse”, while examples of positive words are “gain”, “improvement”, and “profitable.” We use a standard measure of tone:

which is the ratio of net positive words to the sum of positive and negative words in the transcript. We express tone in %.

Ad 3. We focused on so-called “uncertainty words” such as “probably”, “could”, and “maybe”, which were also compiled by Loughran and McDonald (2011). We measured the frequency of such words, that is, the ratio of the number of uncertainty words to total words in the transcript expressed in %.

We counted the number of COVID-related words, as well as the tone and uncertainty for each transcript, and took the average for each calendar quarter, since earnings calls occur quarterly. To zoom in on the most intense (so far) period of the pandemic, we calculated averages for April and May 2020 separately. Throughout this analysis, we make comparisons between Swedish and US firms. In the second part, we also split and compare firms based on their international exposure.

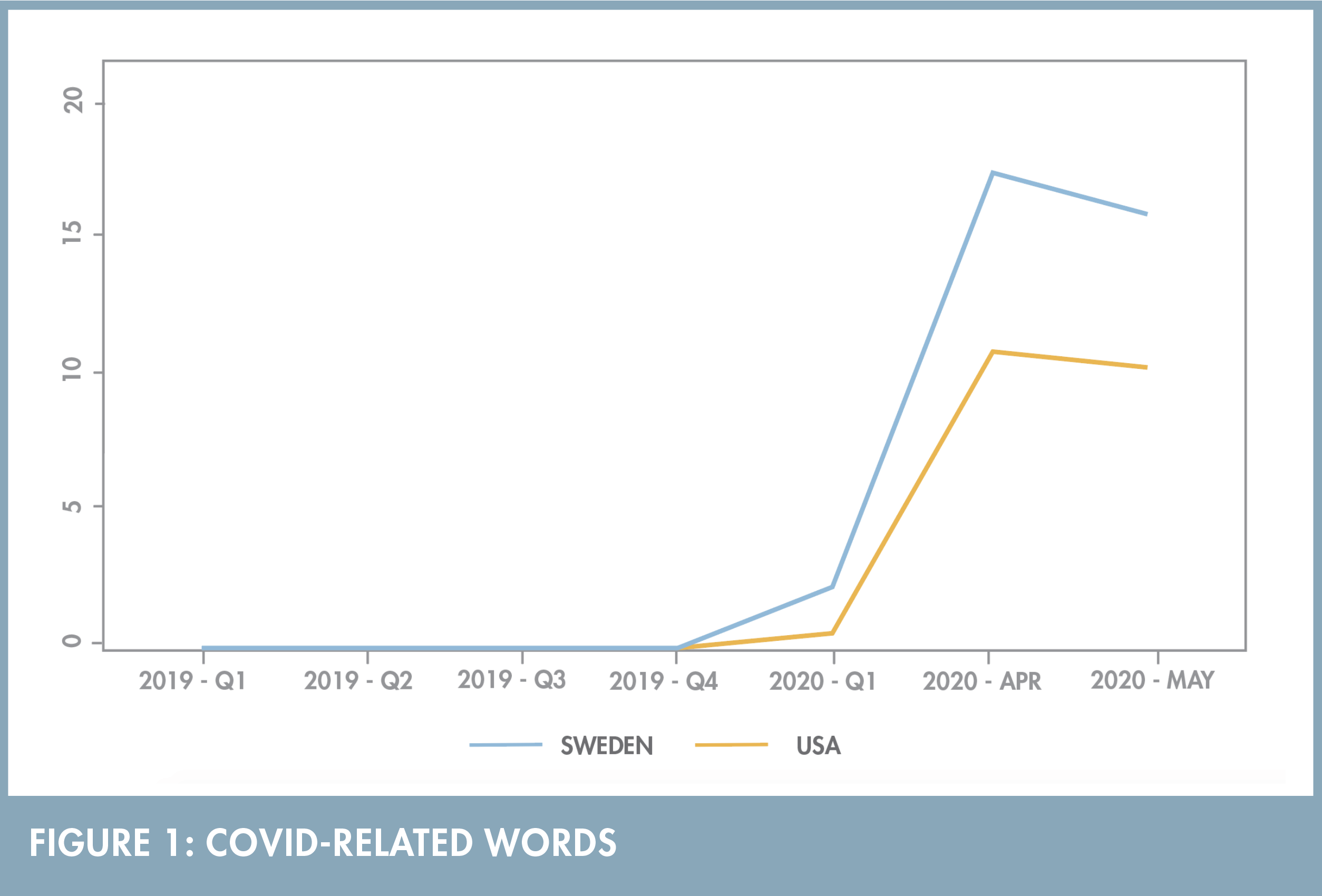

Our first finding relates to the intensity of COVID-related discussions. As Figure 1 shows, none of the companies in the sample raised this topic in 2019, which is what we expected. Then, early in 2020, US firms were first to pick it up and continued to mention it more often than Swedish companies as the intensity of COVID-related discussions spiked in April.

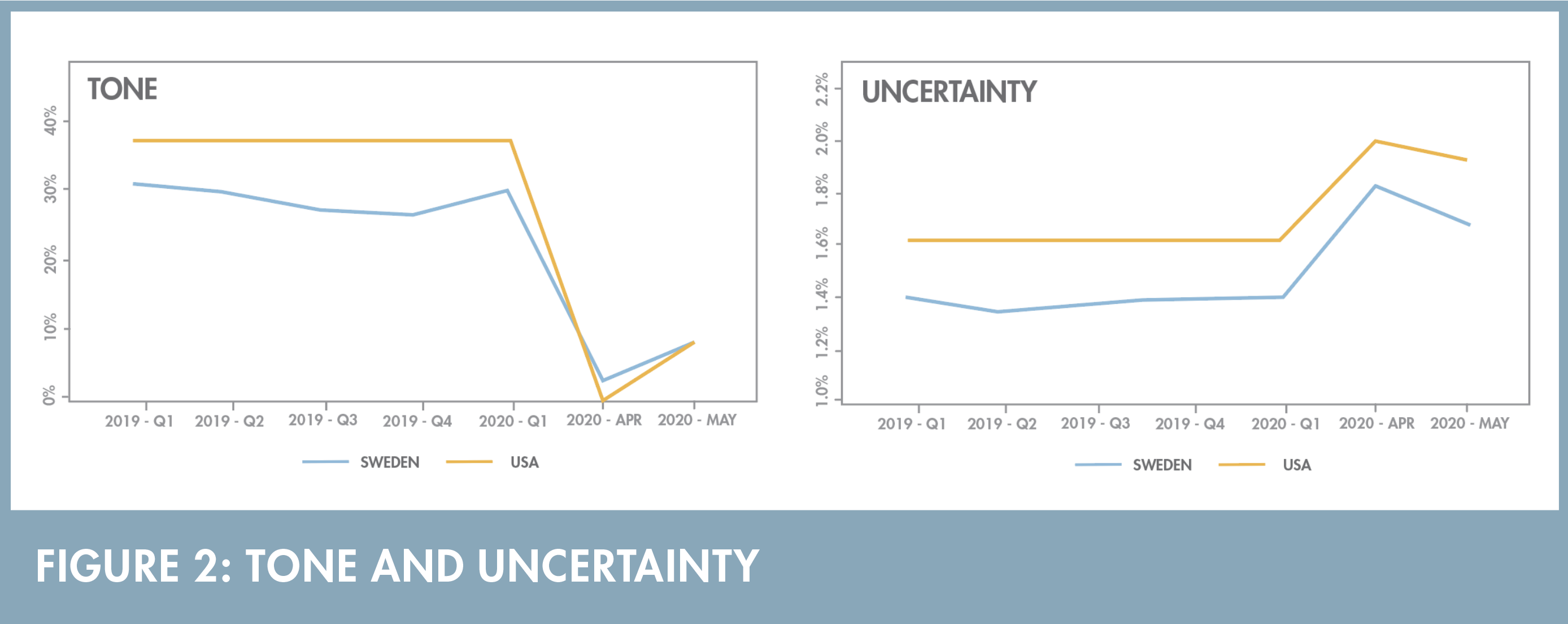

Together with the rise in COVID-related words, the uncertainty in earnings calls also increased and the tone has crashed, see Figure 2. This shows the significant impact of COVID-19 on the condition and outlook of companies in both the USA and Sweden. However, it seems that the negative shift in tone was even more dramatic for US companies (which otherwise tend to be more upbeat), and the uncertainty decreased more among Swedish companies in May.

This suggests that Swedish companies suffered less from the economic fallout, perhaps related to the differences in the public response.

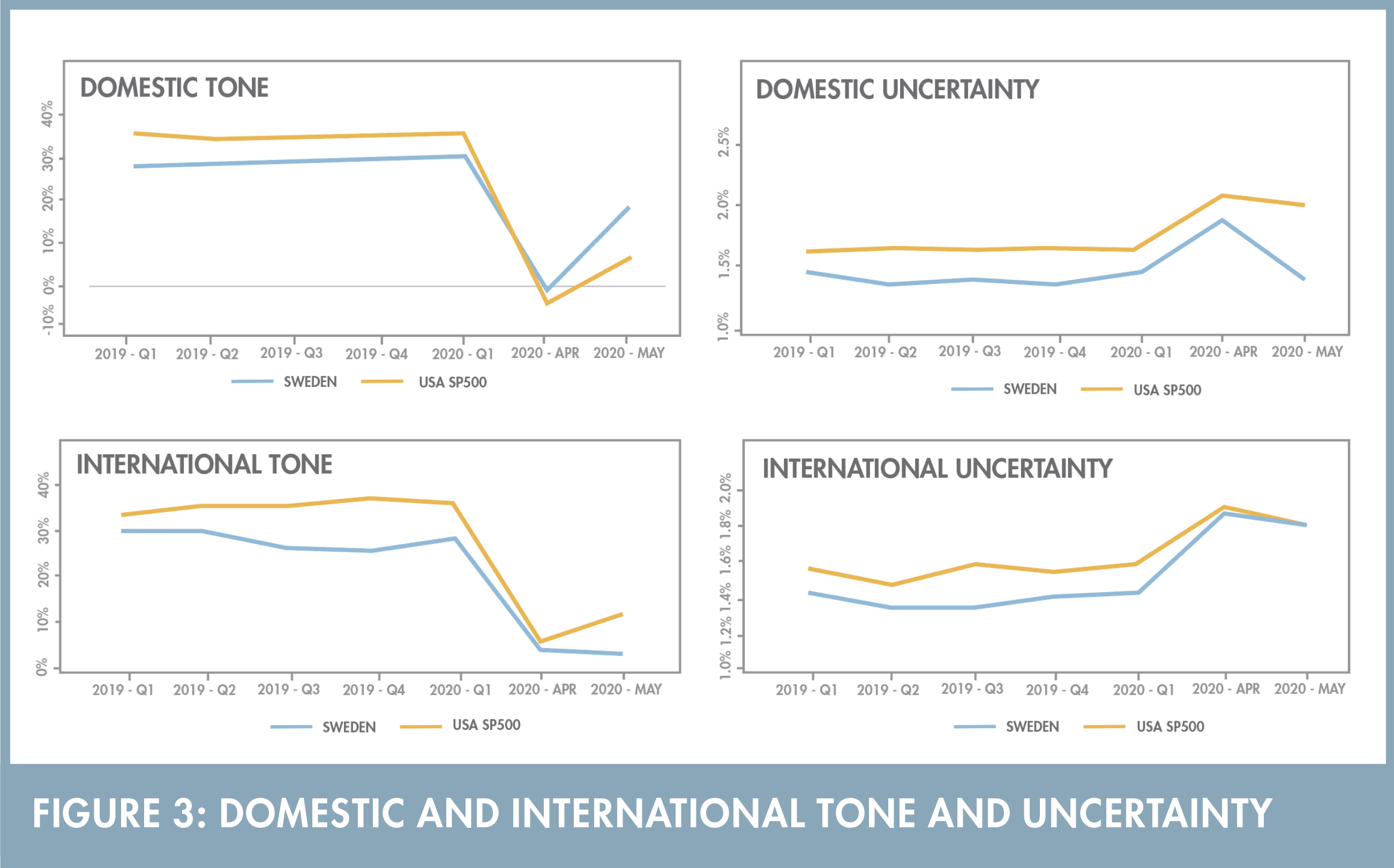

To explore these distinctions further, we split companies based on their reported geographic segment revenue. We define a company as “domestic” if it generated more than 75% of its revenue in its own country and “international” if that figure was less than 25%. If our conjecture about the role of the government’s response is correct, we would expect domestic firms in Sweden to be less affected by COVID-19 than domestic firms in the US, while international firms, which depend more on the global situation, than any particular country, to show similar patterns. Figure 3 provides corroborating evidence.

The tone of quarterly earnings calls by domestic Swedish firms dropped less, and rebounded faster, than the tone of domestic US firms. Swedish domestic firms also appear to get over the COVID-induced uncertainty more quickly. On the other hand, internationally active Swedish firms show a very similar pattern of tone and uncertainty in earnings calls as their US peers.

So, what does this study of quarterly earnings calls tell us? The COVID pandemic was indeed quick to become a central topic in the financial conversation, and it depressed the tone and increased uncertainty for companies in both the USA and Sweden. However, the less restrictive approach of the Swedish government may have also softened the economic blow, at least to Swedish companies that generate most of their revenue domestically.

References

Athanasakou Vasiliki, Eugster Florian, Schleicher Thomas, Walker Martin. “Annual Report Narratives and the Cost of Equity Capital: UK Evidence of a U-Shaped Relation,” European Accounting Review 29:27–54 (Winter - 2020)

Dzieliński, Michał, and Wagner, Alexander F. and Zeckhauser, Richard J., Straight Talkers, Vague Talkers, and the Value of Firms (December 2, 2018). HKS Working Paper No. RWP17-017; Swiss Finance Institute Research Paper No. 17-13. Available at SSRN: https://ssrn.com/abstract=2965108 or http://dx.doi.org/10.2139/ssrn.2965108

Hassan, Tarek Alexander, and Hollander, Stephan, and van Lent, Laurence and Tahoun, Ahmed, Firm-level Exposure to Epidemic Diseases: COVID-19, SARS, and H1N1 (April 2, 2020). Available at SSRN: https://ssrn.com/abstract=3566530 or http://dx.doi.org/10.2139/ssrn.3566530

Loughran, Tim, and Bill McDonald. “When is a liability not a liability? Textual analysis, dictionaries, and 10‐Ks.” The Journal of Finance 66, no. 1 (2011): 35-65.

Loughran, T., & McDonald, B. (2016). Textual Analysis in Accounting and Finance: A Survey. Journal of Accounting Research, 54(4), 1187–1230. https://doi.org/10.1111/1475-679X.12123

Ramelli, Stefano, and Wagner, Alexander F., Feverish Stock Price Reactions to COVID-19. Review of Corporate Finance Studies, (Forthcoming).

The authors

Michał Dzieliński is an affiliated researcher at the Swedish House of Finance at Stockholm School of Economics. He is Assistant Professor at Stockholm Business School at Stockholm University.

Florian Eugster is Assistant Professor at Department of Accounting at Stockholm School of Economics. He is also affiliated to Mistra Center for Sustainable Markets (MISUM) at Stockholm School of Economics.