Escape from the city

Oct. 21, 2021

Will home-rents and house-prices in city centres revive post-covid, or is suburban living here to stay?

There was a time, not very long ago, when renting, or acquiring a home in a bustling city centre was considered the height of luxury and success. It wasn’t just the closeness to a wide array of shops, restaurants, bars and theatres that enticed people to pay steeply for city living, it was time gained from lengthy commutes, and easy access to a plethora of work and business opportunities, often promising higher compensation. Then Covid-19 struck, and suddenly hustle and bustle was the last thing we wanted. Those who could, fled the cities to the suburbs or countryside, spurring a significant wave of urban migration induced by government lockdowns and working from home imperatives.

The question is, how have these changes affected urban real estate values and rents, and are the changes we’ve seen permanent or transitory? What are the short-term versus the longer-term perspectives? How will it all impact how we live and work in the future?

These questions were explored in the winning 2021 Skandia Award study entitled Flattening the Curve: Pandemic-Induced Revaluation of Urban Real Estate, which was presented at Sweden's national center for financial research, The Swedish House of Finance, at the Stockholm School of Economics on 21 October 2021.

Stijn Van Nieuwerburgh, Professor of Real Estate and Finance at Colombia University, and fellow researchers Arpit Gupta, Vrinda Mittal and Jonas Peeters, studied the evolution of rent and house price gradients in 30 major metropolitan areas of the United States, covering the last three years. The study establishes that pandemic-triggered urban flight has indeed benefitted the suburban real estate sector and hurt the urban core. Over the long term, however, the finding of this study, which primarily focuses on residential real-estate, predicts an urban revival.

Rents versus prices

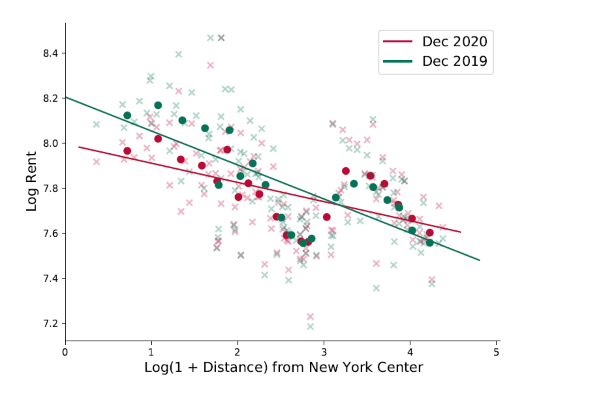

Using data on urban migration based on zip-codes, mobile telephony, house price comparisons between urban centres and suburbs, and rental price comparisons between urban centres and suburbs, the researchers established that up until March 2020 both rents and house prices declined as the distance to downtown centres increased. That is the normal, expected relationship, based on urban real-estate developments over the last 30-40 years.

But in March 2020, the rent gradient between city centres and suburbs began to increase at a rapid pace, almost reaching zero by the end of the year. This unprecedented flattening of the so-called bid-rent curve, suddenly showed a clear increase in how much people were now willing – or able – to pay for homes in the suburbs relative to homes in close proximity to the urban core.

The house-price gradient experienced a similar change as the rent gradient, but to a lesser degree. Van Nieuwerburgh explains that the difference between the house price and rent gradients is the main empirical finding of the study; one which indicates that housing markets over time expect an urban revival.

"Rents declined drastically in city centers and they grew strongly in suburbs"

Why working from home is a dominant migration-driver

So, what has driven that variation? Having studied several different factors including differences between the 30 cities when it comes to ease of remote working, covid policy stringency measures, inelasticity in supply (i.e. how easy or difficult is it to move), the team observed that working from home was been the number one driver.

“Working remotely is pretty comfortable, no more commuting for example,” explains Van Nieuwerburgh. “In addition, a lot of the things we used to love about city centres before covid, like having lots of people around us in shops, bars, discos, training centres, cinemas, is still something a majority of us now try to avoid."

“Looking at New York and San Francisco, cities where it is quite easy to work from home – where many people are employed in office-type environments like the digital tech sector, academia, banking, insurance and other types of professions which don’t require constant physical presence – have seen the largest rent gradient changes,” continued Van Nieuwerburgh.

“When we dug down, we could even see that there was a large variation in the rent gradient changes at the zip code level, and it’s this variation which has allowed us to disentangle the urban amenity story from the working from home story with a good level of confidence. We used the closure of bars and restaurants as a proxy for urban amenities, and continued to find that rent changes during the pandemic were more strongly driven by working from home than by urban amenities.”

What will stay, and what will go?

The team also used a Pulsenomics survey with more than 100 expert forecasters, requesting their perspective as to whether the covid-induced housing market changes will be permanent or transitory. 36% of responders said permanent, i.e. that the shift in real-estate rents and prices from the city core to the suburbs will remain in the December 2020 state, while 64% said transitory, expecting that as pandemic-induced working from home imperatives recede with vaccination levels rising, and pandemic lock-downs and restrictions softening, that life in the city will go back to pre-covid levels.

An average calculation of these perspectives, prompted the study’s conclusion that urban centre home prices and rentals will recover over time, albeit, maybe only partially.

Commercial real-estate: a ticking time-bomb affecting the future of city life?

As Van Nieuwerburgh points out, Flattening the Curve primarily covers residential real-estate, but we must not forget that commercial real-estate has suffered dramatically as a result of the pandemic, which is a longer story that is still playing out.

Read more in a separate interview with Stijn Van Nieuwerburgh, where he provides further insights about the study, as well as his own perspectives on other influences with potential to affect future real estate markets.

About Stijn Van Nieuwerburgh

Stijn Van Nieuwerburgh is Professor of Real Estate and Professor of Finance at Columbia University. His research lies in the intersection of housing, asset pricing, and macroeconomics.

About the Skandia award

In order to increase knowledge of how long-term savings contribute to a sustainable society the Thule Foundation at Skandia supports research in the area of ‘Long-term savings.’ The Foundation provides, in collaboration with the Swedish House of Finance, a research prize for outstanding researchers through the annual Skandia Award.

Share