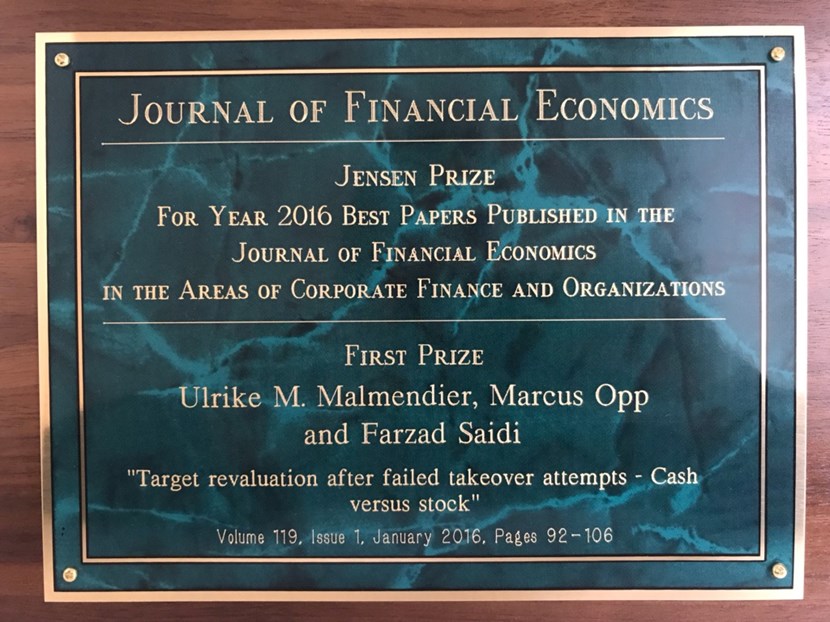

First prize to Farzad and Marcus

jun. 07, 2017

Congratulations to Farzad Saidi, Assistant Professor, and Marcus Opp, joining Swedish House of Finance in August as Associate Professor, for being awarded the Jensen Prize for the best paper published in the Journal of Financial Economics in the areas of corporate finance and organizations for their paper ”Target revaluation after failed takeover attempts – cash versus stock” written together with Ulrike Malmendier.

Farzad, Marcus, and Ulrike examine the informational effect of the bidder’s strategic decision to use cash versus stock on the target’s stock return. They find that targets of unsuccessful cash-financed takeover bids are revalued by + 15 percent after deal failure, whereas stock-financed targets return to pre-announcement levels. The results are consistent with cash bids revealing prior undervaluation of the target.